- Introduction

- Chapter 1. Local budgets in Belarus: the particularities

- Chapter 2. Legislative issues related to the local budgets in Belarus

- Chapter 3. Systematic violations made by authorities in the formulation of local budgets

- Conclusions

Introduction

This document analyzes the particularities of the process of formulation, accessibility and transparency of local budgets in Belarus drawing attention to various aspects of state budgeting, including legislative and especially practical aspect – the way ordinary voters are affected. This analysis should serve think tanks and organizations working in the field of democratic and non-violent transformation of Belarus, as well as for organizations and general public concerned with the issues of local governments.

In Belarus, budget is adopted and implemented at four levels each year:

- National budget;

- Regional budgets: budgets of 6 regions (oblasts) and the budget of Minsk;

- Local budgets, basic level: budgets of cities of the oblast subordination and district budgets (118);

- Local budgets, primary level: budgets of district-level towns (14), budgets of the townships (25) and budgets of the village councils (1180).

It should be noted that national budget is separate and does not include other kinds of budgets. The term “consolidated budget” refers to the national budget and other budgets combined (and does not take into account transfers between these budgets), however, it is not used very often.

Chapter 1. Local budgets in Belarus: the particularities

1.1. State budgeting on the local level includes yearly quotas for fines that have to be paid by the local residents

Each local budget has an item of income “Fines and deductions” (Appendix 1 on the decision of the local Council of Deputies). It turns out that the local executive committee prepares a certain plan for fines in advance, regardless of the extent to which citizens and organizations in the area are actually breaking the law.

In order to execute the plan the state bodies start looking for any pretexts to issue fines in one way or another, and often do it even when there is no offense. The process of appealing fines is cumbersome and requiring large amount of own financial resources, as well as time. For example, it costs approximately 100 Euros to hire a lawyer for filing appeal, a sum which roughly equals the monthly pension in Belarus, not to mention that the review of appeal can take more than six months. There are also few chances to win the case against state in the court with non-independent judges, as they are in Belarus. As the matter of fact, under such circumstances there are no possibilities for citizens for appealing.

1.2. Subordinate local councils can request additional money from higher-level local budgets; this measure is widely used.

The budget of any scale requires equilibrium: ideally, revenues and spending should each amount to equal sum. However, all Belarusian budgets except the national budget often fix the imbalances with transfers from higher-level budgets. The request for intragovernmental fiscal transfer is made by the local government during the process of budget formulation. Later on, in accordance with the figures indicated, the transfer is made from the higher-level budget to the subordinate one.

The implementing bodies at basic and primary budget levels actively use the opportunity to request money from a higher-level budget in order to compensate budget deficit. It should be taken into consideration that the economic situation in the region affects the state of its budgets and its ability to request for transfers in a sense that better-off regions with large profitable enterprises in their territories would have more difficulties in justifying the need to receive budget transfers. Paradoxically, this is the reason why in some cases it is not beneficial for local governments to support enterprise in the area.

1.3. The size of the local budget largely depends not on the quantity and quality of private business, but on the number of government-funded organizations.

Many legal entities in Belarus are governmental organizations, fully financed by the state (so called budgetary organizations).

Since local authorities themselves do not set goals and do not use budgeting to solve local issues, the majority of financing goes to the budgetary organizations. They have to meet certain obligations and conditions and there are means of monitoring.

However, the existing practice makes it financially more beneficial for local councils to support budgetary organizations and increase their number, rather than create an environment that is supportive for private enterprises.

The size of the local budget in Belarus does not depend on the number of taxpaying businesses – instead, it depends on the total number of budget holders. At the same time, all budgetary activities are oriented towards the achievement of so called “social norms”; however, the results are evaluated not by the local population, but instead by the representatives of departments concerned. As a result, Belarus simply does not have mechanisms through which residents of specific settlements can influence public policies.

1.4. Instead of development goals, budget spending is dependent on arbitrary social standards, which are never negotiated with the population.

The size of local budgets is based on the standards of per capita budgeting, as well as other social standards. These standards are called “State social standards for serving the public of the Republic” and are periodically adopted by a resolution of the Council of Ministers. In the next phase, the regional (oblast) executive committees, based on the approved system of state social standards, develop and approve a list of social standards for serving the public for administrative and territorial units by taking into account their specifics and the level of development of infrastructure.

Here are two examples of social standards set by various departments: “List of state social standards for serving the public of Bobruisk” (http://bobruisk.by/economics/standards/ ) and “State social standards in the field of culture in the Orsha district for 13.10.2017” (http://orshalib.by/sotsialnye-standarty.html).

When formulating social standards, the Council of Ministers uses the figures provided by each department. For example, the Ministry of Health sets standards for hospital beds and attending physicians for 1000 people, the Ministry of Education sets standards for the number of places in schools, the Ministry of Culture – the number of rural clubs, etc. At the same time, each ministry uses its own indicators of the provision of social services that are “subordinate” to it. These indicators are not public. The quality of public services therefore is an intra-departmental, non-transparent, and completely closed to the public process. The social security standards are not negotiated with citizens. As a result, the distribution of public services and institutions is asymmetric: for example, Slonim with a population of 49 thousand people has its own Academic Theater, whereas there are no theaters at all in Orsha with population of 115 thousand people.

Budget expenditures in Belarus therefore are not result-oriented, expenses are made to achieve certain social standards; however, there are no specific policy goals.

1.5. The local budgets are in fact irrational. Because of the funding model and top-down approach in budget planning the development of local businesses is hindered. The inadequate revenues at the local level are compensated by transfers from the national budget.

Since different administrative units have different degrees of absorption from their own funds, they receive different amounts of transfers from higher-level budgets. The national budget is at the top of this triangle.

The financial resources are being redistributed between the regions and the city of Minsk through the national budget in order to balance their economic and social development. Thanks to this mechanism of redistribution, only the national budget can be run at deficit, and local budgets are deficit-free (that is, there is always money to compensate their expenditures).

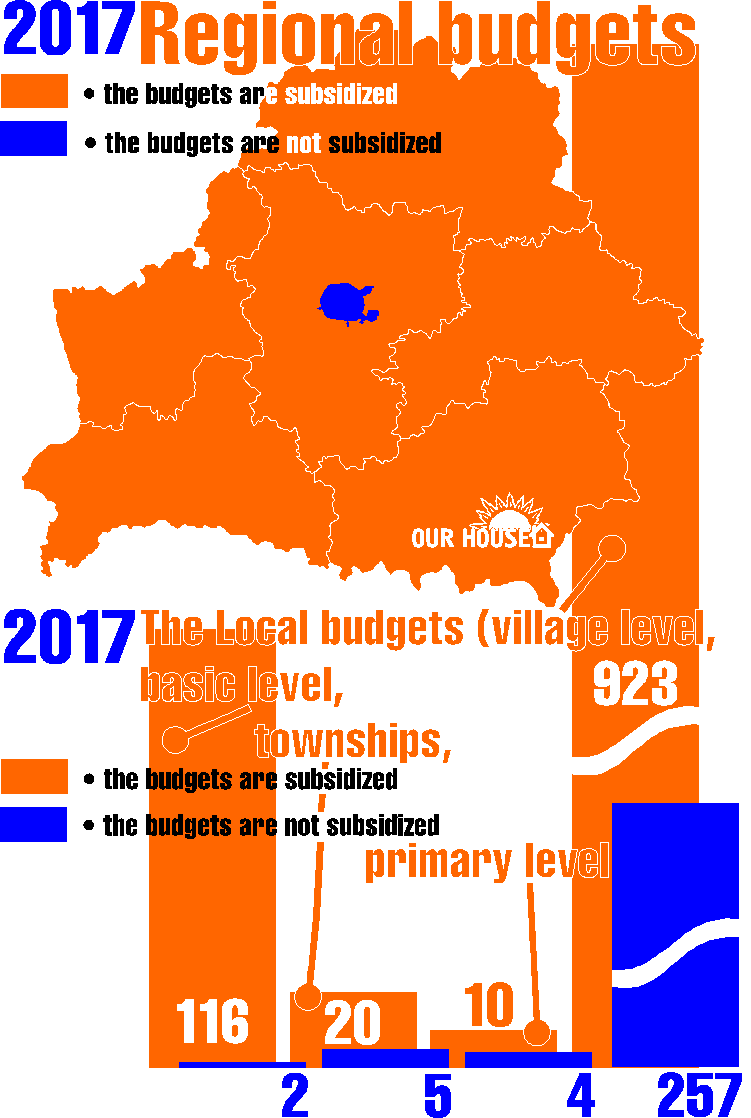

In 2017, all six regional (oblast) budgets were subsidized; and while having the same status, the budget of Minsk was not subsidized. Out of 118 district budgets, only 2 were not subsidized, and 116 were subsidized. Out of 1,180 budgets of village councils, 257 were not subsidized. Out of 25 budgets of the township councils, 5 were not subsidized. Out of 14 budgets of the district-level towns, 4 were not subsidized.

In most cases, local budgets are not sustainable and cannot cover all their expenses.

In 2017, the national budget for expenditures amounted to 16,739,0 090,345 rubles, out of which the subsidies amounted to 2 275 786 776 rubles that were transferred to the consolidated budgets of the regions (oblasts) and the budget of Minsk – that is 13.6% of the total national expenditures. These funds went directly to the local budgets. More considerable sums were transferred to the regions in the form of grants (for example, for Chernobyl catastrophe recovery, for the quota of housing, for the development of agriculture, for infrastructure construction, for gasification of settlements, etc.). Transfers, subsidies, and grants to local budgets made up 25% of the budget expenditures in 2017.

Chapter 2. Legislative issues related to the local budgets in Belarus

Budget policy in Belarus is officially regulated by a single legislative document – the Budget Code which was adopted in 2008 ). However, in practice, there are also secret resolutions of the Ministry of Finance that are not included in the Budget Code.

According to the Budget Code, local councils make decisions on the local budgeting. These decisions are in force for one year during the execution of budgets. Adoption of the local budget is preceded by the process of drafting budget, which is done by economists of the relevant executive committee. This is how the overall picture looks like to an outsider, someone who does not really get into details of the issues related to the budgeting.

2.1. Issues regarding the Budget Code

There is no a separate chapter in the Code dedicated to local budgets

The regulations of local budgets are not listed in a separate chapter, but are scattered along the document and can be found in chapter 15 (articles 83-87), 17 (articles 92-94), 18 (articles 95-97), 19 (articles 98-100), 20 (articles 101-105), 24 (articles 117-124). The Budget Code is not well structured and therefore one needs to read the entire document in order to find relevant information.

The Code does not provide a single template for local budgets

Chapter 17 on “Drafting local budgets” does not include any actual draft and there are no instructions of the procedures and regulations the drafting process should follow. There are only indicators in the Article 93 on “Indicators approved by the local Council of Deputies regarding the budget for the next financial year,” which are of technical and abstract nature and cannot guide in drafting the local budget in any way.

In fact, there are neither procedures indicated nor deadlines foreseen for drafting local budgets in the Article 94 on “The procedure and deadlines of drafting local budgets.” The article is quite extensive and at the same time is far from being informative. The deadlines and timeframe for drafting budgets are not specified (except from the information that all budgets are drafted for one year), there is no specified procedure for budgeting.

There are no mechanisms for consulting the general public in the budgeting process

The regulations do not foresee the role of citizens in the budgeting process. The Code does not mention that budgets should somehow be negotiated with the public.

There is no information on how the report on the implementation of local budgets should be prepared

Article 124 on “Reports on the implementation of local budgets” of the Budget Code does not contain any information at all on exactly how such a report should look like and what kind of data should it include.

Secrecy and non-transparency of legislative processes

Article 124 contains a reference to the document of the Ministry of Finance that defines the form and content of the accounting of local authorities. There is no open access to this document, but budgets in the Republic of Belarus are modeled according to the standards approved by the Ministry of Finance, as it is stipulated in the Budget Code. The Code also stipulates that the budget performance (implementation) reports are modeled after the Ministry of Finance, but such template is not public as well and has not been published anywhere.

Chapter 3. Systematic violations made by authorities in the formulation of local budgets

Article 8 of the Budget Code on “Principles of the Budget System of the Republic of Belarus” (http://kodeksy.by/byudzhetnyy-kodeks/statya-8) provides the guidelines that local budgets should follow. Unfortunately, it must be noted that a number of principles are ignored and not taken into account when drafting the local budgets.

3.1. Violation of the principle of transparency in the formulation of local budgets

Formally, the Belarusian legislation declares full transparency of the budgeting process: “5. The principle of transparency means the openness to the society and the mass media of such procedures as reviewing and adoption of the law on the Republican budget for the next financial year, the decisions of local councils of deputies on the budget for the next financial year, and the publication of approved budgets and reports on their execution in the mass media in the established order, provision of complete information on the execution of budgets (except for information classified as state secrets).”

However:

– There is no established procedure for the publication of budgets in the mass media; such procedure has never been implemented;

– Decisions of local councils on the budget are published on the official websites of local executive committees exclusively at the requests of “Our House” (through the action of activists) and very rarely – on officials’ own initiative;

– “Our House” is still working towards the publication of all the local budgets online (at the moment we are targeting executive committees and plan to address the councils afterwards);

– “Our House” has not yet started disclosing exhaustive information on the status of budget implementation, and the local councils do not provide such information to the public on their own initiative.

3.2. Violation of the principle of unity

The principle of unity means that the budgetary system of the Republic of Belarus is ensured by a single legal framework, a single monetary system, a single regulation of budgetary relations, a single budget classification of the Republic of Belarus and a single outline for budget implementation, accounting and reporting.

Unfortunately, there is no uniformity in disclosing local budgets; moreover, there is no single template for disclosing the budget.

Up to now, there are at least 5 different ways in which local councils have been publishing local budgets.

For example, 7 local councils publish budgets in a separate Word file, 3 local councils publish budgets in a separate .pdf file, 4 local councils – in the form of a general reference to the state legal website parvo.by, 7 local councils – in the form of a direct hyperlink to the same website, 2 local councils – in the form of a separate page. Such practice definitely leads to confusion and does not serve the reason for disclosing budgets in the first place.

Let us have a look at different ways the local budgets of 2017 were made available to the public:

FIVE VERSIONS OF PUBLICATIONS

OF THE LOCAL BUDGETS FOR 2017

ON THE WEBSITES OF THE LOCAL EXECUTIVE COMMITTEES

| № | Council of Deputies | Separate Word file | Separate .pdf file | General reference to the website | Direct hyperlink to the website | Separate page |

| 1. | Mozyr

district |

+ | ||||

| 2. | Soligorsk

district |

+ | ||||

| 3. | Lida

district |

+ | ||||

| 4. | Maladzyechna

district |

+ | ||||

| 5. | Zhlobin

district |

+ | ||||

| 6. | Svietlahorsk district | + | ||||

| 7. | Rechytsa

district |

+ | ||||

| 8. | Slutsk

district |

+ | ||||

| 9. | Minsk

сity |

+ | ||||

| 10. | Gomel

сity |

+ | ||||

| 11. | Mogilev

сity |

+ | ||||

| 12. | Vitebsk

сity |

+ | ||||

| 13. | Grodno

сity |

+ | ||||

| 14. | Brest

сity |

+ | ||||

| 15. | Bobruisk

сity |

+ | ||||

| 16. | Baranovichi

сity |

+ | ||||

| 17. | Pinsk

сity |

+ | ||||

| 18. | Polotsk

сity |

+ | ||||

| 1. | Gomel

regional |

+ | ||||

| 20. | Mogilev

regional |

+ | ||||

| 21. | Vitebsk

regional |

+ | ||||

| 22. | Grodno

regional |

+ | ||||

| 23. | Brest

regional |

+ | ||||

| TOTAL: | 7 | 3 | 4 | 7 | 2 |

In each case the quality of the publication depends on the officials and their willingness to make the information available to the public. A good example is the Vitebsk region. The website of the Vitebsk Oblast Executive Committee (http://www.vitebsk-region.gov.by) does not only present all the information in the form of a standard report – there are also sections “Execution of local budgets” (http://www.vitebsk-region.gov.by/ru/new_url_606634817-ru/) and “Budget for citizens” (http://www.vitebsk-region.gov.by/ru/bjudzhet-dlja-grazhdan/), in which budget-related questions are presented in a clear and readable manner.

If you look at the report on the Minsk city budget, the picture is completely different (https://minsk.gov.by/ru/normdoc/3768/). Budget revenues, expenditures, sources of financing and other points are scattered across several annexes of the document as separate tables. There is neither a city budget in the form of a single summarized table that is suitable for analysis nor is there a report table regarding budget implementation. Moreover, this approach has not changed over the years. Here you can find the budget for 2018: https://minsk.gov.by/ru/normdoc/4047/.

The situation in the cities of regional subordination and district centers is even worse. The main reason for that is old and dysfunctional websites. However, even in this category there are differences between councils. For example, the administration of Bobruisk publishes not only a report on the implementation of the budget in a standard form (http://pravo.by/document/?guid=3961&p0=D918m0088088) – however, not on its own website, but on a national legal website pravo.by. There is also a summary available (the so-called “bulletin”) in a form of slideshow (http://bobruisk.by/data/_quarantine/doc-bobr-by2.pptx). This means that any citizen can follow the implementation of the budget, regardless of their knowledge of accounting. The budget of Pinsk (http://pravo.by/document/?guid=12551&p0=D918b0087720&p1=1) looks similar to the one of Bobruisk. And on the website of Pinsk City Executive Committee, there is even an explanation with pictures about how the city budget was executed. (This initiative is called “Budget for citizens”: http://www.pinsk.gov.by/files/%D0%91%D1%8E%D0%B4%D0%B6%D0%B5%D1%82%20%D0%B4%D0%BB%D1%8F%20%D0%B3%D1%80%D0%B0%D0%B6%D0%B4%D0%B0%D0%BD%202018.pdf).

However, in the report of Molodechno district, a row of dashes can be seen in the part on the budget implementation (http://pravo.by/document/?guid=12551&p0=D917n0082186&p1=1&p5=0). It appears that the budget did not receive transfers from higher-level budgets, does not have reserve funds and did not plan to finance, for example, courts or capital construction. Such financial reporting looks somewhat immature. In any case, the explanations of the budget committee of the district executive committee will be required for a thorough analysis.

On the other hand, one of the good practices was that the Council of Deputies of Polotsk district provided a separate entry for “The size and direction of the regional budget surplus” in the budget report (http://www.pravo.by/document/?guid=12551&p0=D917v0081148&p1=1). However, it is almost impossible to understand it without explanations of the economist of the executive committee or an accountant.

The Orsha district budget for 2017 is made according to the regulations of the Ministry of Finance – like all other budgets. However, there is no report on its implementation in the public domain, as well as the budget performance report for 2016. Nevertheless, with an in-depth study of the site, budgets of a number of rural Councils of Deputies were discovered. However, the information of the past few years is rather fragmented and chaotic. There is also no single procedure for their submission, also, there is no recent budget data, as well as there are no reports on the implementation of these budgets.

3.3. The principle of the efficient use of the budget is not respected

Unfortunately, while formulating local budgets, no long-term, medium-term and short-term goals are set, and there are no indicators that can be used to assess how efficiently budget funds are spent. That is, a certain funding is directed to governmental organizations without assessing whether the funding is spent properly and efficiently. Indicators for the assessment of local budgets are also not set in the Budget Code.

3.4. The principle of accountability of the participants of the budgetary process is not respected

The principle of accountability of the participants of the budgetary process means that all officials involved in the budgetary process are responsible for their actions (or inaction) at each phase of the budgetary process.

The problem is that the Budget Code does not explain when the liability starts for certain violations. Since the responsibilities of the participants of the budgetary process are also not defined, this principle a priori cannot be respected.

Conclusions

- Budget legislation and budgeting practice in Belarus are de facto two separate processes that are not related to each other.

- Budget legislation is a complicated process which is lacking structure and logic. There are a lot of regulations that are too abstract, and some important points lack accuracy.

- The process of the formulation of local budgets is closed from the public or even secret. The contributors cannot be identified – their identities are not available to the public and even to the deputies from local Councils of Deputies.

- Local Councils are not motivated to encourage the development of private business or implementing result-oriented policies. Instead, increasing the number of budgetary organizations is used as a means of obtaining additional financing from higher-level budgets. As a result, it breeds bureaucracy and discourages entrepreneurial initiatives, at the same time burdening national budget.

- Almost all budgets of local Councils of Deputies are subsidized from the national budget and their balance is negative.

- “Our House” and other representatives of civil society must systematically demand for transparency in the formulation of local budgets and monitor their implementation, as the local authorities are not likely to disclose such information on their own initiative. It seems that they are content with the status quo. In general, there are few initiatives to influence budgetary processes at the local level (besides “Our House”, there are some other local activists). One of the reasons for that could be the lack of knowledge needed in order to understand budget formulation.

- The lack of free elections in Belarus means that the local Council of Deputies are often appointed by the lists of local executive committees and do not show interest in monitoring the budget.

In practice, this means that local deputies blindly vote for any draft of the budget which is prepared and provided by the local executive committee.

As a result, each year the so-called “discussions” about local budgets (and reports on their implementation) by deputies of local Councils of Deputies becomes just another bureaucratic procedure. In the post-Soviet history of Belarus, there have been no cases when local deputies did not accept the draft of the local budget proposed by the local executive committee or, for example, sent it for revision. As a rule, voting on budget is very formal and rapid process; it takes a third or a half of the session of the local Council of Deputies, which starts and ends on the same day.